RFM Analysis for Email Marketing: How to Cut Costs

Customers behave differently: some order frequently, others rarely, and some haven’t opened your emails in a long time.

RFM analysis helps bring order — dividing your customer base into groups based on activity and purchase value. This way, emails become more targeted: active clients aren’t annoyed by irrelevant messages, while “dormant” ones can be re-engaged with a compelling offer.

In this article, we’ll explain how RFM analysis works, how to set up segments, and how to use them in email campaigns to save budget and increase orders.

What Is RFM Customer Analysis and Why Use It

RFM analysis (Recency, Frequency, Monetary) is a method that categorizes customers into groups based on three criteria: how recently they made a purchase, how frequently they buy, and how much they spend.

RFM is used to segment customers by their activity and value to the business. It helps identify the most profitable and loyal clients, as well as those who’ve stopped buying and need extra attention. This approach makes marketing more accurate and reduces unnecessary spending.

In email campaigns, RFM helps avoid sending the same messages to everyone. Active clients only need updates and useful content — they don’t require frequent discounts. For those who haven’t purchased in a while, you can prepare a special offer or promotion to regain their interest.

As a result, the customer base is divided into RFM segments, each with its own communication scenario. This reduces costs on unnecessary discounts and bonuses, increases the effectiveness of email sequences, and improves targeted ad results.

Companies see more repeat orders, better retention, and stronger loyalty — all with less waste.

How to Conduct RFM Analysis in Email Marketing

1. Gather the data. Export from your CRM or database: customer ID, date of last purchase, total number of orders, and total purchase amount. If the data is spread across different tables, consolidate it into one.

2. Calculate R, F, and M.

Recency — how much time has passed since the last purchase (in days or months).

Frequency — how many orders the customer placed during a set period (e.g., over the past year).

Monetary — how much money the customer spent in total over that same period. Sometimes average order value is used, but total spend gives a fuller picture of customer activity.

3. Define the scale. Split each metric into categories: for example, 1 = high, 3 = low. The exact thresholds depend on your business: for daily food delivery, “hasn’t ordered in a while” might mean a week; for furniture, it could mean six months. To do this, sort the data from low to high and divide it into levels — for example, groups with low, medium, and high values.

| Metric | What it means | 1 — Best Score | 2 — Average Score | 3 — Weak Score |

|---|---|---|---|---|

| Recency | How recently the customer bought | Recently | Moderate time ago | A long time ago |

| Frequency | How often they buy | Frequently | Occasionally | Rarely |

| Monetary | How much they spend | A lot | Moderate amount | A little |

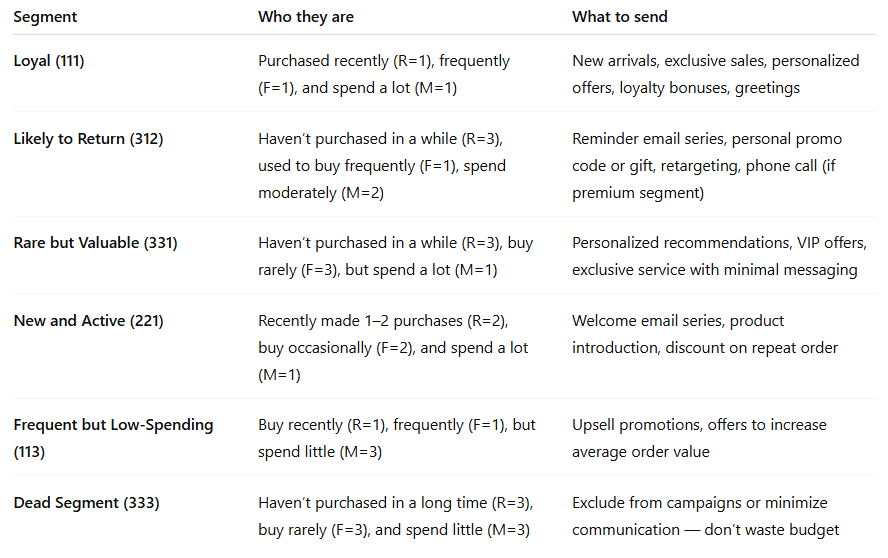

4. Assign scores to each customer. Calculate three scores — R, F, and M. You’ll get a segment code, for example: 111 (recent purchase, buys frequently, spends a lot) or 333 (hasn't ordered in a long time, buys rarely, spends little). Typically, up to 27 combinations are used, but they can be grouped later for simplicity.

5. Give segments clear names. For example, 111 — “loyal and active,” 333 — “dormant,” 311 — “churned but used to spend a lot.” In email marketing, such labels immediately suggest what type of message each segment should receive.

6. Set up email campaigns for each segment.

- Active customers don’t need discounts — send them new arrivals and helpful content.

- Occasional buyers — send a personal offer or reminder.

- Dormant customers can be reactivated with a promotion or bonus.

- Those likely to churn — send a survey or a reason to stay.

7. Review segments regularly. Customer behavior changes. Update your RFM scores at least once a quarter. As your database grows, you can make the scale more granular — for example, using a 5-point system instead of 3.

RFM Segment Examples and How to Use Them

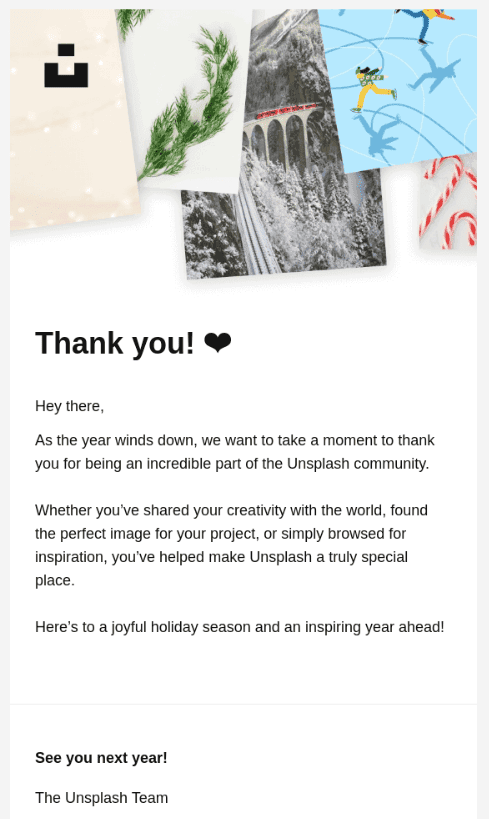

Loyal customers (e.g., segment 111). This is the most reliable part of your audience — they purchased recently and spend more than others. In email campaigns, these subscribers should receive updates about new arrivals and special invitations to loyalty programs. Regular emails can include thank-you messages for their trust, holiday greetings, and bonuses for long-term loyalty.

They don’t need frequent discounts — they’re already buying. It's better to focus on service quality and exclusive offers. It’s also helpful to occasionally ask for their feedback on products or service — loyal customers are more likely to respond and share recommendations.

By the way, you can quickly design such emails using the Pixcraft editor.

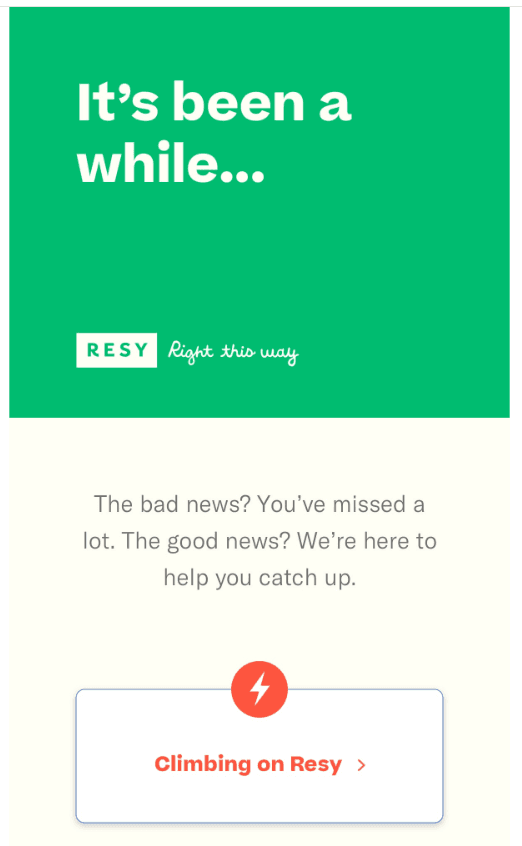

Likely to Return (311). These customers were once active or high-spending but haven’t ordered in a while. The potential for reactivation is high. An email sequence works well: start with a gentle reminder about the brand, followed by a personal promo code or gift. If the customer typically makes high-value purchases or deals with premium products (e.g., real estate or vehicles), you can also involve a personal manager or make a phone call. It’s important not to delay reactivation — the longer the customer is inactive, the more expensive it becomes to win them back.

New and Active (211). These customers have recently made their first or second purchase — the goal is to build the habit of buying.

Introduce them to popular products, highlight your brand’s advantages, and offer a discount or gift for a repeat purchase.

A survey can help collect data on their preferences and improve personalization.

Rare but High-Spending (331). These customers place orders infrequently but spend a lot. They don’t need mass emails — only personalized offers and exclusives. You can offer consultations, private sales, or special services. The key is to maintain their interest in the brand without overwhelming them.

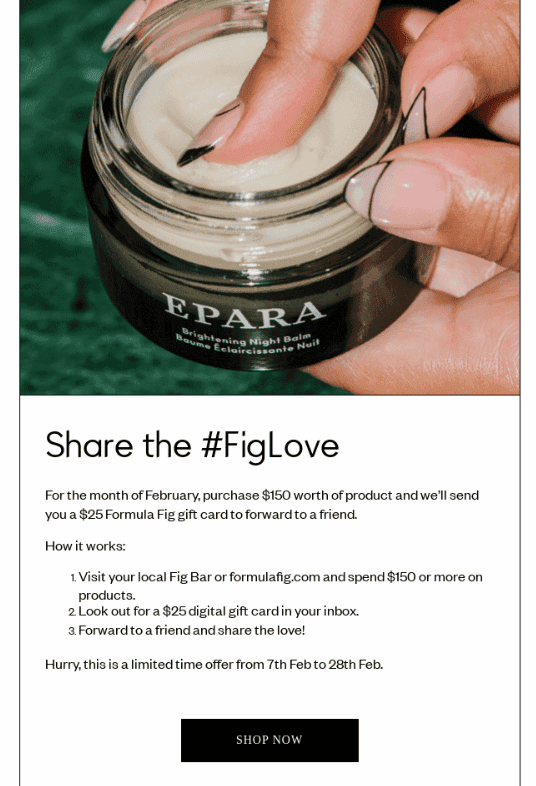

Frequent but Low-Spending (113). These customers love the brand but buy low-cost items or place small orders. The goal is to increase their average order value. Emails with offers like “buy more — get a gift” or “free shipping over a certain amount” work well. You can also promote bundles, upsells, and complementary products.

Dead Segment (333). These customers haven’t purchased in a long time, spent little, and did so infrequently. It’s better not to spend budget on them — the response rate is minimal. They can occasionally be included in mass sales, but the priority should go to new and loyal groups.

Automating RFM Analysis

1. Spreadsheets (Excel, Google Sheets). For small businesses or testing hypotheses, Excel is enough. You can compile order history into a table: calculate the date of last purchase, number of orders, and total spend per customer. Then use formulas or filters to assign scores: who gets “1”, “2”, or “3”.

This data can be exported to your email platform to create basic segments right away. However, for large databases or frequent updates, this method becomes unreliable quickly.

2. BI tools or database + script. If the data is stored in a database, an analyst can write an SQL query or script. This code automatically calculates Recency, Frequency, and Monetary values, assigns scores, and writes them to a separate table or directly into customer profile fields.

The advantage: segment updates are automated and scheduled.

The downside: it requires technical specialists. Still, it’s convenient for email campaigns — segments from the database can easily sync with your ESP or CDP for scheduled launches.

3. CRM, CDP, and marketing platforms. If you already use a CRM or CDP, check if built-in segmentation is available.

For example, in CDP Altcraft, segments can be generated automatically. These segments connect directly to email campaigns, allowing you to set up automated flows for “loyal,” “new,” or “dormant” customers.

The benefit: segments are recalculated with every new order or data change, so you don’t need to monitor updates manually.

Limitations of the RFM Method

1. Works only with customers who have already made purchases. RFM won’t show which subscribers have never placed an order and won’t help identify “cold” leads. For email marketing, this means part of your list — potential customers — remains outside of RFM-based segmentation. Solution: track those who haven’t purchased yet but actively open emails and click links — segment them separately and nurture with onboarding flows or first-purchase promos.

2. Requires a sufficient customer base and order history. If a company has only 200 customers or just launched a store, splitting them into dozens of groups is pointless — some segments will be empty. For small lists, it’s better to rely on basic triggers (welcome emails, cart reminders, reactivation) and focus on data collection. RFM becomes meaningful once you’ve reached at least 1,000 customers and several thousand orders.

3. Static segmentation becomes outdated quickly. RFM shows which segment a customer belongs to right now, but behavior changes fast. Someone who was active six months ago may not even open emails today. If segments aren’t updated automatically, emails start going to the wrong people. Solution: use automated calculations in a CDP.

4. Only considers three factors. In reality, subscriber behavior is influenced by many other things: seasonality, product type, sales channel. RFM doesn’t account for these. For example, a customer might order rarely not because they lost interest, but because the product is purchased once a year. For email marketing, this matters — such segments don’t need “Discount! Come back!” emails. Solution: enrich RFM with additional attributes — e.g., preferences from surveys or engagement data (which emails they open most often).

5. Doesn’t predict future behavior. RFM is about the past. It shows who was active or dormant, but doesn’t estimate how much a customer will spend tomorrow or whether they’ll leave for a competitor.

How to Expand RFM Analysis for Email Marketing

RFM covers basic segmentation needs, but in email marketing, that’s often not enough. To make segments even more precise, it's common to combine RFM with other approaches.

LTV Prediction. One approach is to combine RFM with Lifetime Value (LTV) prediction models. This way, segments show not only who is loyal now, but also how much value a customer is expected to bring in the future. For example, you can calculate the expected LTV for both “loyal” and “dormant” customers separately and set up different email flows: retention messages for some, and more aggressive promotional campaigns for others — if the return justifies the cost.

Behavioral Metrics. RFM only accounts for purchases, but in email marketing, overall engagement is also important: who opens emails, clicks links, or visits the website. This data can be combined with RFM. For example, a customer may be making frequent purchases but hasn’t opened an email in a while — that’s a signal to send a personalized reminder or even make a call, especially if it’s a high-value B2B client.

Composite Segments and Advanced Models. RFM is often enhanced with ABC analysis — this identifies which products or categories generate the most revenue. It helps build effective cross-sell campaigns: offering “loyal” customers exactly the products they’re most likely to buy.

Conclusion

RFM analysis is one of the most reliable ways to segment your customer base based on actual behavior.

In email marketing, it forms the foundation for targeted strategies: active customers receive updates and personalized offers, while “dormant” ones are re-engaged with promos and reminders.

To keep segments accurate, it’s best to automate the calculations and enrich them with additional data.

This approach makes email performance more predictable and drives more repeat sales — without unnecessary expenses.